Use one of the following options to submit 1040X |

|

Option |

Information |

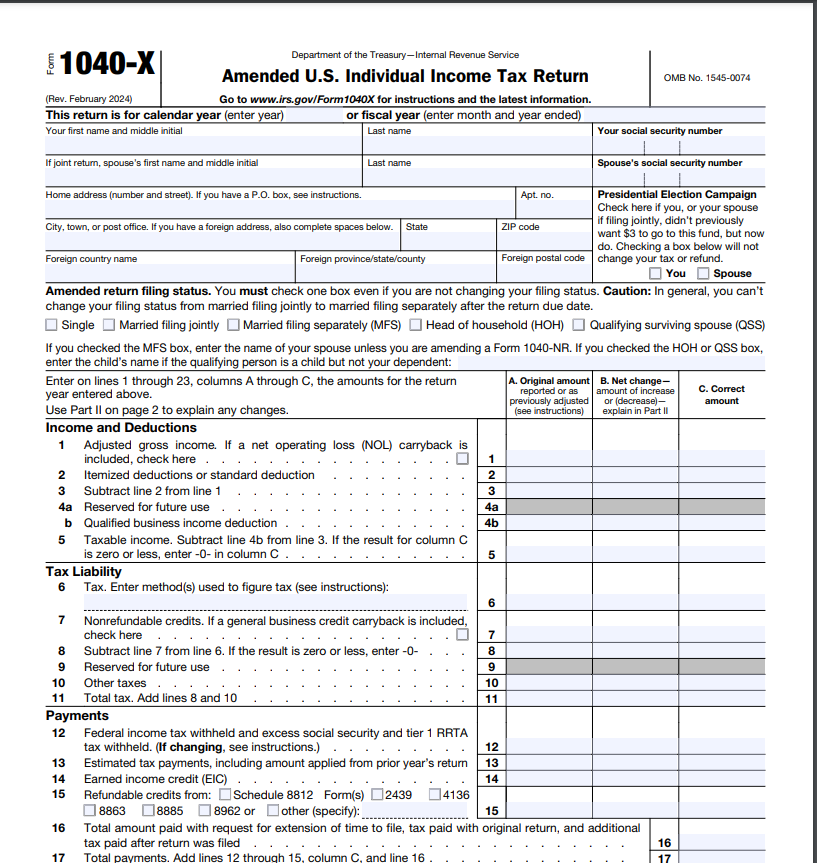

| #1 | Submit a signed copy of your IRS Form 1040X that was filed with the IRS to correct original filed tax return |

| #2 | If minor corrections were made internally by the IRS without a 1040X, submit the IRS

letter explaining changes made or provide a Tax Account Transcript with a Tax Return

Transcript

|